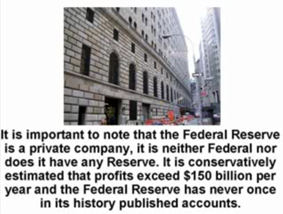

미국의 FRB(연방준비제도)은 사립(私立)은행의 집합체로 주요 소유자는 록펠러, 골드만 삭스, 로스차일드 등의 유태계 재벌이다 FRB는 상업어음의 재할인이나 공개시장의 조작으로 각 지구의 금융통제를 맡고 있다.

|

세계의 많은 나라들은 오늘날 FRB가 공개수수료를 얼마만큼 올리느냐 내리느냐에 일희일비하면서 신경을 곤두세우고 있다. FRB를 지배하는 세력이 사실상 세계금융을 지배한다.

미국의 ‘Yellow Page’(업종별 전화번호부)를 보면 ‘연준’은 정부기관란이 아닌 민간기업란에 있다. 이와 비슷한 경우가 영국의 중앙은행이다. 영국의 중앙은행은 원래 로스차일드 가문의 개인 소유 은행이었다가 1946년 노동당 정부가 국유화 했다. 공식적으로는 국가 소유지만, 실질적으로는 여전히 민간은행의 성격을 띠고 있다.

로스차일드가(家)는 독일의 프랑크푸르트에서 일어났다. 제1대인 마이어 암셸 로스차일드(1744~1812)는 아들이 5형제가 있었다. 그는 아들들을 모두 어릴 적부터 상인으로 철저하게 훈련시킨 다음, 당시의 유럽 5대 도시에 파견했다. 5대 도시는 프랑크푸르트, 비엔나, 나폴리, 파리, 그리고 런던 이었다. 5형제는 모두 각 도시에서 금융업으로 성공을 거두었다.

로스차일드가는 돈을 꿔주는 입장에서 전쟁이 날 때마다 더욱더 발언권을 얻게 되었고, 강력한 세력으로 중앙은행을 지배했다. 로스차일드 가문의 금융 지배력은 유럽에만 국한되지 않았다. 대서양 건너 미국에서도 엄청난 힘을 발휘하게 됐다. 그것은 바로 FRB를 통해서였다.

한국은행법 1조는 韓銀의 목적을 ‘물가 안정’으로만 명시해 놓고 있다. 반면 FRB는 설립 목적에 ‘물가 안정’뿐만 아니라 ‘고용-성장률 제고를 통한 국민경제 발전’이 포함돼 있다. 미국 경제 위기, 나아가 세계경제 위기의 주범은 어떻게 보면 시장 기능을 믿지 않는 FRB 때문이라고 해도 과언이 아니다. FRB가 반복적으로 경제를 불안하게 만드는 원인은 통화정책을 통해 경제를 안정시키는 데 있어서 민간은행 연합체인 FRB가 안고 있는 근본적인 한계 때문이다.

2007년 세계 경제를 위기로 몰아넣은 ‘서브프라임 모기지 사태’도 알고 보면 별개 아니다.

FRB의 이자율 조작이 투자를 왜곡하고 경제주체들이 상황을 제대로 판단하지 못하도록 만들어 투자자들은 과열투자로, 소비자들은 소비과열로 몰아간 것이다. FRB의 시장 개입은 주택가격을 지속 불가능할 정도로 높여놓았고, 미국인들을 광란의 소비로 몰아넣은 것이다.

'물가안정'뿐만 아니라 '고용' 및 '성장률 제고'를 위해서는 경기변동이나 다른 거시경제 변수의 변화를 파악하고, 화폐수요를 정확히 예측해 통화량을 잘 조절해야 한다. 그러나 화폐수요 추적에 있어 각종 정보문제로 FRB가 통화량을 성공적으로 조절하는 것은 매우 어렵다.

잘하면 상관없지만 실패가 많아 문제인 것이다. 이런 문제를 제기하면 ‘무슨 反美하냐’는 비판을 받는데, 기자는 이들에게 과연 미국의 이런 문제를 알고 있었느냐고 반문하고 싶다. 미국이 우리의 동맹국가이다. 그러나 친구의 사정에 대해서도 잘 알고 있어야 한다.

김필재(조갑제닷컴) spooner1@hanmail.net

[출처 FRB] Who owns the Federal Reserve?

The Federal Reserve System fulfills its public mission as an independent entity within government. It is not 'owned' by anyone and is not a private, profit-making institution.

As the nation's central bank, the Federal Reserve derives its authority from the Congress of the United States. It is considered an independent central bank because its monetary policy decisions do not have to be approved by the President or anyone else in the executive or legislative branches of government, it does not receive funding appropriated by the Congress, and the terms of the members of the Board of Governors span multiple presidential and congressional terms.

However, the Federal Reserve is subject to oversight by the Congress, which often reviews the Federal Reserve's activities and can alter its responsibilities by statute. Therefore, the Federal Reserve can be more accurately described as 'independent within the government' rather than 'independent of government.'

The 12 regional Federal Reserve Banks, which were established by the Congress as the operating arms of the nation's central banking system, are organized similarly to private corporations--possibly leading to some confusion about 'ownership.' For example, the Reserve Banks issue shares of stock to member banks.

However, owning Reserve Bank stock is quite different from owning stock in a private company. The Reserve Banks are not operated for profit, and ownership of a certain amount of stock is, by law, a condition of membership in the System. The stock may not be sold, traded, or pledged as security for a loan dividends are, by law, paid to member banks at a maximum rate of 6 percent, determined in part by each member bank's total assets.

Related Information

Federal Reserve Board issues interim final rule regarding dividend payments on Reserve Bank capital stock

The Federal Reserve System: Purposes and Functions

Related Questions

What is the purpose of the Federal Reserve System?

What does it mean that the Federal Reserve is 'independent within the government'?

Does the Federal Reserve ever get audited?

Is the Federal Reserve accountable to anyone?

How is the Federal Reserve System structured?

영란은행도 유태인 거지요

영란은행도 유태인 거지요

FRB 의 주주에 관한 해설 : http://www.federalreserve.gov/faqs/about_14986.htm